Firms With a High Degree of Operating Leverage Are

Easily capable of surviving large changes in sales volumeB. Usually trading off lower levels of.

Operating Leverage And Degree Of Operating Leverage

Easily capable of surviving large changes in sales volume B.

. All of the options are true. The degree of operating leverage DOL is a multiple that measures how much the operating income of a company will change in response to a change in sales. Dtrading off higher fixed costs for lower per-unit variable costs.

Here we also take a degree of operating leverage examples of companies like Colgate Amazon Accenture and sectors including IT Services Utilities. Firm has higher variable costs. Firms with a high degree of operating leverage are A.

In a high operating leverage situation a large proportion of the companys costs are fixed costs. Stocks with a high operating leverage can be identified in any sector or industry but some of them have a high structural operating leverage. Firms with a high degree of operating leverage are.

The companys degree of operation leverage is ______. Operating leverage is a cost-accounting formula that measures the degree to which a firm or project can increase operating income by increasing revenue. Firm A employs a high degree of operating leverage.

A business that generates sales with a high. Firms with a high degree of operating leverage are A. Csignificantly affected by changes in interest rates.

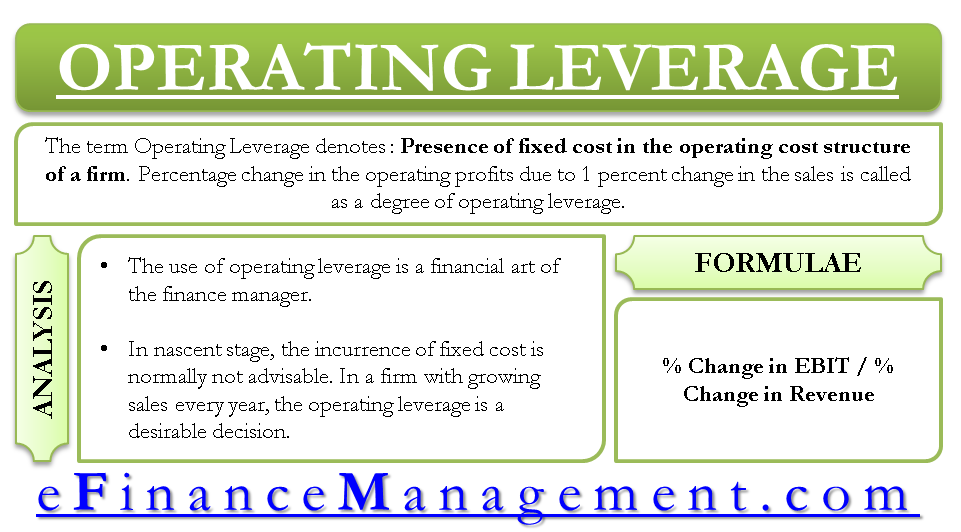

The degree of operating leverage is computed as. If the degree of operating leverage higher for a company this means that the company is more risky than another company. Firms with a high degree of operating leverage are Select one.

In this case the firm earns a large profit on each incremental sale but must attain sufficient sales. The degree of operating leverage may be defined as. Below are some examples that come to mind.

Usually trading off lower levels of risk for higher profits. Usually trading off lower levels. Financial leverage deals with.

Significantly affected by changes in interest rates. Company A has sales of 1200000 for 20000 units sold variable costs of 25 per unit and fixed costs totaling 560000. Percent change in operating income divided by percent change in unit volume.

Q P-VC divided by Q P-VC-FC. The percent change in operating income divided by the percent change in unit volume. Using high levels of debt financing to magnify earnings.

Firms with a high degree of operating leverage are Aeasily capable of surviving large changes in sales volume Busually trading off lower levels of risk for higher profits. Firm s profits are more sensitive to changes in sales volume. Significantly affected by changes in interest.

Leverage can be defined as the ability of a firm to use its fixed cost assets or funds to magnify the returns to shareholders. Compared to the industry average implies that the. All of the options are true.

Firms with a high degree of operating leverage are A. Fixed costs are high in the Industrials Telecoms equipment Materials Utilities and Energy sectors. Firms with a high degree of operating leverage are A.

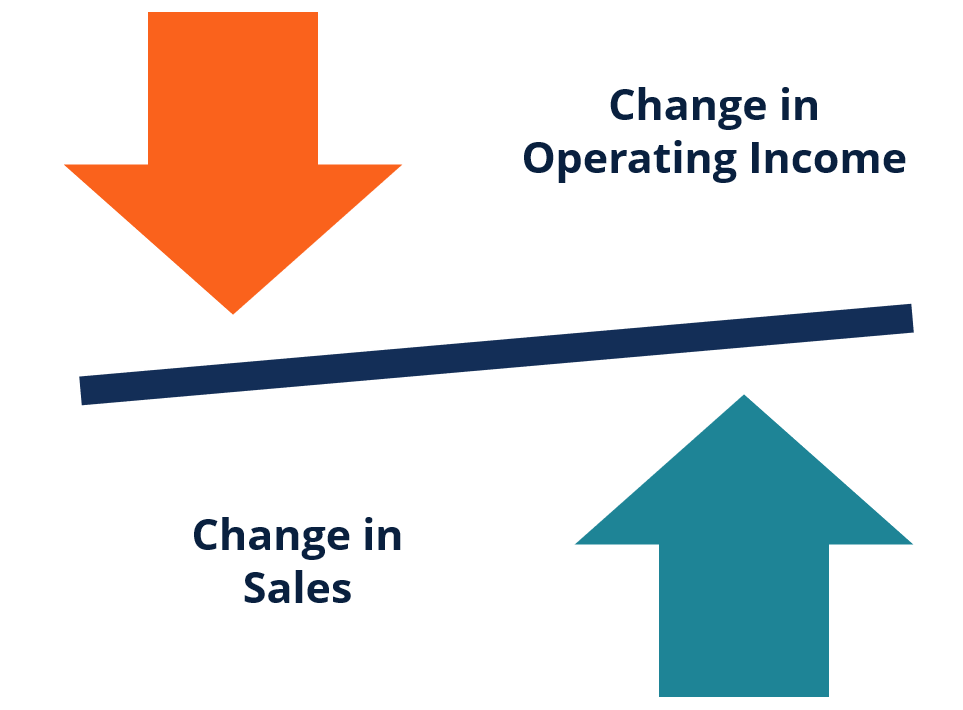

The following two scenarios describe an organization having high operating leverage and low operating leverage. Brigham Leverage is created when a firm has fixed cost associated either with its sales and production operation or with its financing characteristics. A low degree of operating leverage points the other way indicating that the firm uses more variable assets to support the core business leading to a lower gross margin.

Airlines large amount of fixed costs per flight leisure industry eg hotels cruise ship operators movie theaters theme parks with large amounts of fixed costs chemicals large production units entailing fixed costs e. Easily capable of surviving large changes in sales volume B. Usually trading off lower levels of risk for higher profitsC.

Easily capable of surviving large decreases in sales volume. Keeping all factors constant the higher the contribution margin the higher the operating leverage. Using lower levels of risk in order to achieve higher profits.

Should my firm aim for a high or low operating leverage ratio. Firm B takes a more. A firm with a higher degree of operating leverage when.

A firm with a higher degree of operating leverage whencompared to the industry average implies that the. Companies with a large proportion of. Firm is more profitable.

S-TVC divided by S-TVC-FC. The degree of operating leverage is higher for companies with lower fixed costs c. Companies with a high operating leverage could take advantage of this improving macro-economic environment.

All of the given answers are true. Answer 1 of 6. Easily capable of surviving large changes in sales volumeB.

Trading off higher fixed costs for lower per-unit variable costs. Weston Scott Besley and E. High operating leverage businesses will need to maintain high sales to cover their fixed costs.

Trading off higher fixed costs for lower per-unit variable costs.

Degree Of Operating Leverage Formula How To Calculate Dol

Operating Leverage Formula And Excel Calculator

No comments for "Firms With a High Degree of Operating Leverage Are"

Post a Comment